Running a business is difficult to begin with, the last thing you need is to be bogged down by spreadsheets, missed invoices and financial headaches. It’s 2025, and the right accounting software is no longer a luxury — it is your business’s ever-present, ever-silent partner, working tirelessly behind the scenes to ensure your finances remain in tip-top condition as you focus on growing your operations. But with so many alternatives out there, how do you decide? Two giant players are: Zoho Books and QuickBooks. And while Zoho Books is generally the lesser-known of the two, let’s shine a light on this underappreciated competitor.

“Even if we do not talk about 5G (specifically), the security talent in general in the country is very sparse at the moment. We need to get more (security) professionals in the system”

So imagine this: You’re a small business owner, and you’re wearing ten different hats — sales, customer service, marketing, and yes, a somewhat reluctant accountant. You need a software that not just crunches numbers but gets your hustle too. That’s where Zoho Books shines. From the Manufacturer Simplest and most affordable no clip carriage it’s like the friendly neighbor who helps you get your finances in order, minus the overpowering).

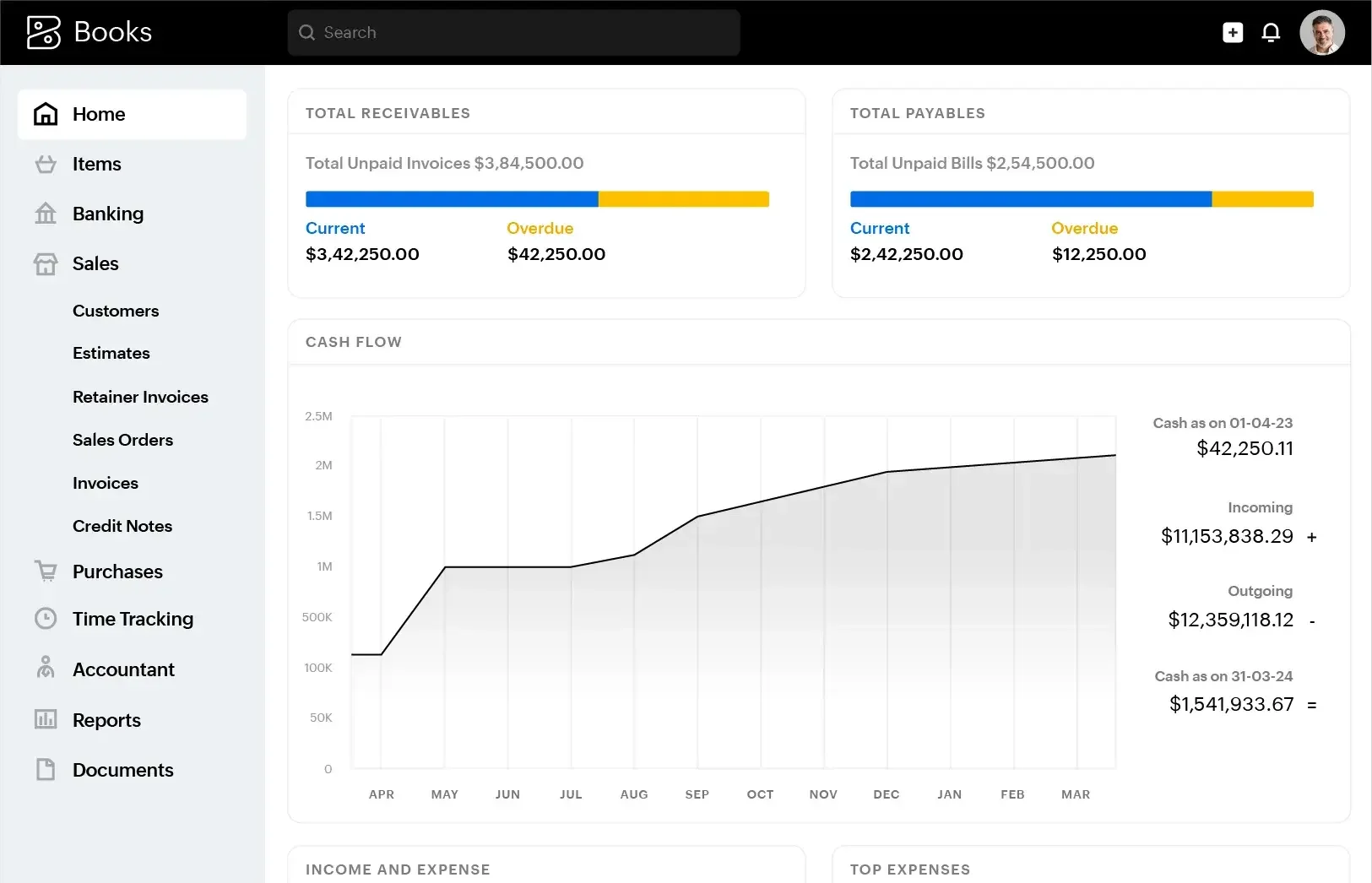

What does Zoho Books do well? There is anyway, and for one thing, it’s designed for real people — not just accountants. The UI is clear, simple and not burdened by jargon. Need to invoice on the go? Zoho’s mobile app allows you to do it in seconds. Worried about tax compliance? It automatically manages GST, VAT and sales tax as per your region, thus preventing you last-minute panicked rush at the time of filing deadlines. And if you’re already using other Zoho apps (say, CRM, or Inventory), everything syncs smoothly, shaving off the tiresome back-and-forth across disparate platforms. But the best part: Zoho Books grows with you. Starting as a solopreneur?

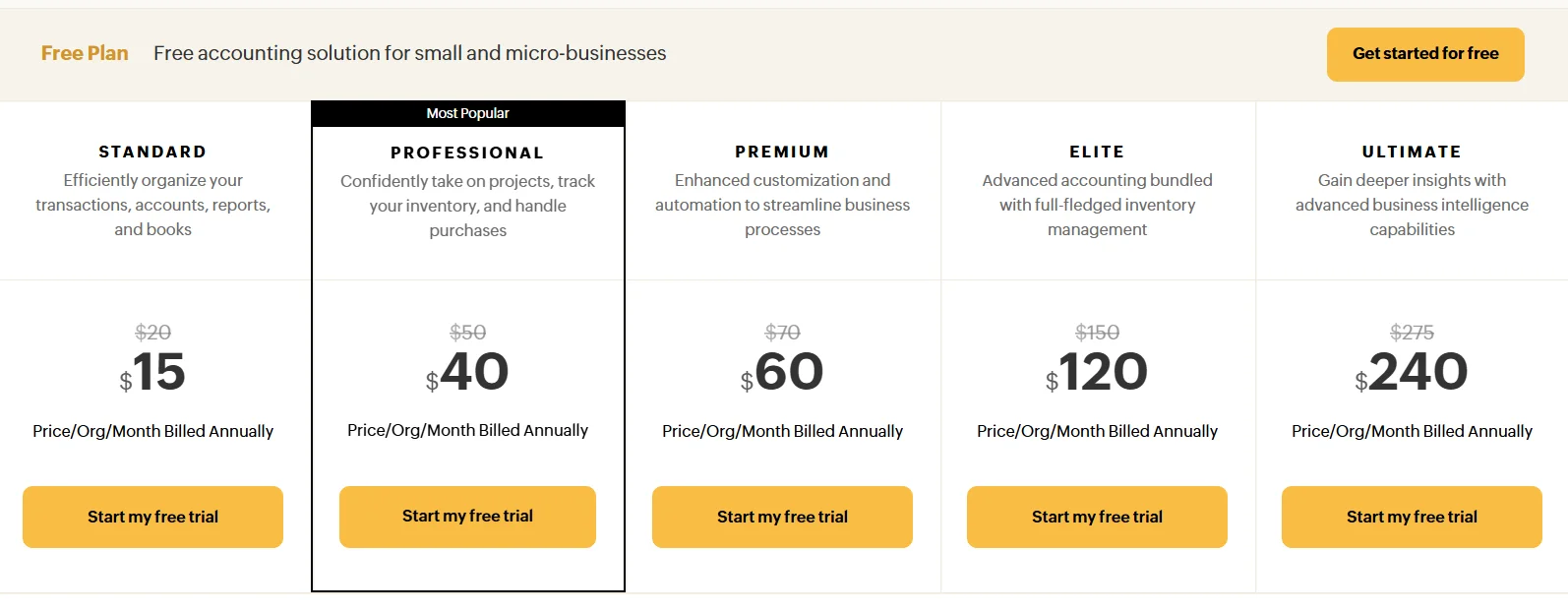

Their free plan includes basic features without overcharging for them. Looking to scale up? Their low-cost paid tiers add features such as automated workflows, project time tracking, and even client portals. Unlike some competitors, they do not have steep price increases.

What Are Zoho Books and QuickBooks?

Zoho Books

Zoho Books is an online accounting system by Indian software developer Zoho Corporation. It’s simple and budget friendly solution as well. Many small businesses and startups appreciate it for having a free plan with essential features. Zoho Books can also take care of sending out invoices, sending reminders to people to pay you and dealing with taxes (like GST, which is good for Indian businesses but also not bad for international ones).

QuickBooks

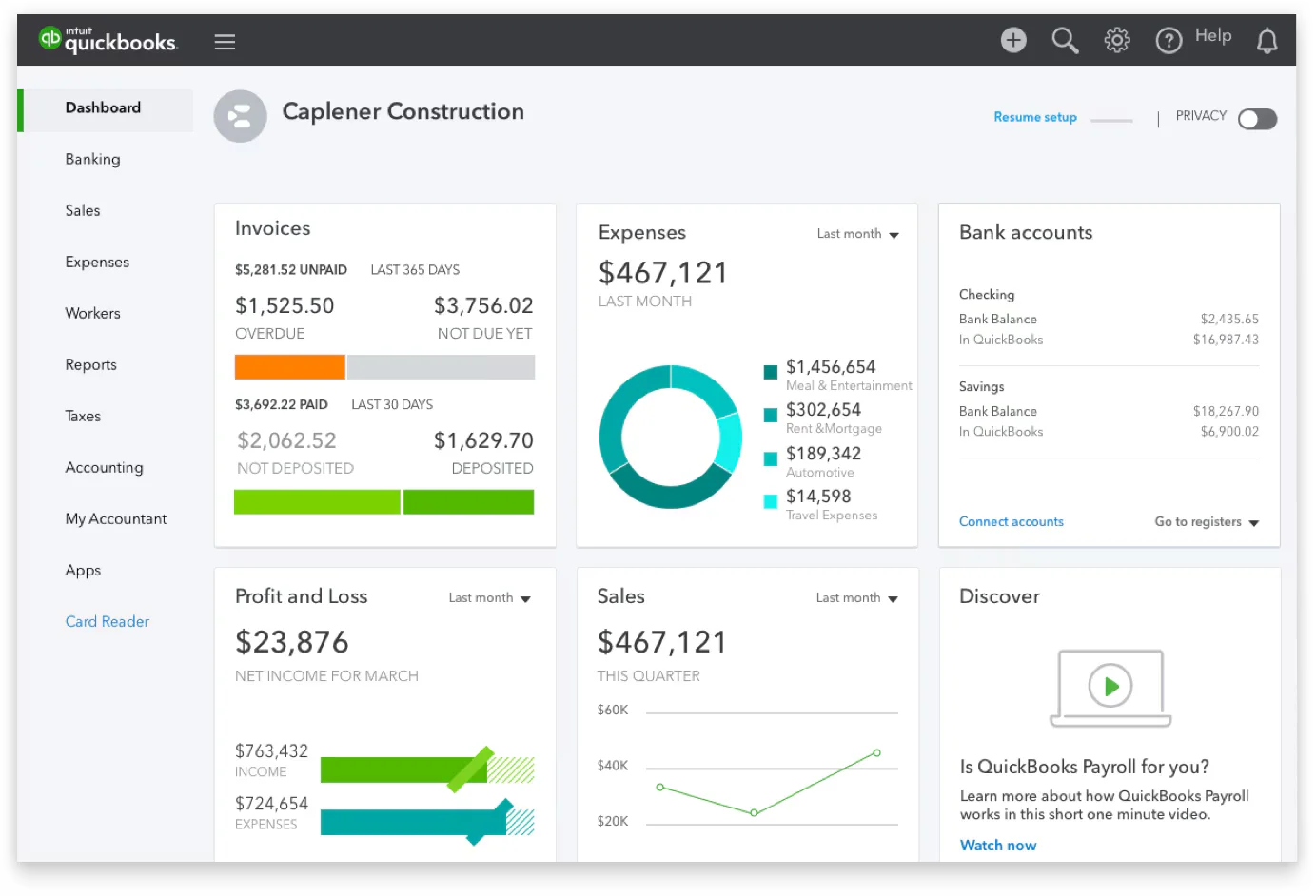

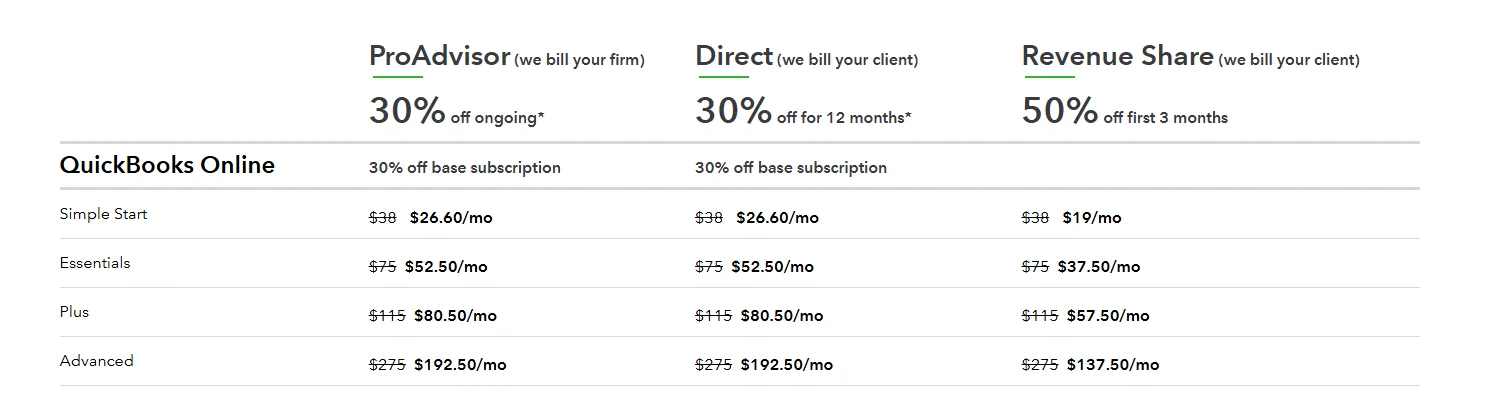

Intuit, an American company, developed QuickBooks, which is an accounting software that is widely used. It has been in existence since 1983 and is utilized by more than 7 million companies globally. QuickBooks is suitable for a wide variety of businesses, from small retail businesses and manufacturers to construction companies and wholesalers. It has robust features overall, particularly in payroll and detailed financial reports.

Zoho Books vs. QuickBooks in 2025: Why Zoho Books Shines for Modern Businesses

When selecting accounting software, price and features are crucial, but finding a solution that integrates seamlessly with your operations is equally important. While QuickBooks is often the center of attention, smart business owners seeking power without the accompanying complexity have found a trusted ally in Zoho Books. Here’s why you should consider Zoho Books in 2025:

Small businesses are often disregarded with unhelpful pricing structures that half unify cash flow schemas.

Free plan businesses with revenues of under 50,000 a year (when did Quick Book sever offer that?)Paid plans start at just 50,000 a year (when did QuickBooks sever offer that?)Paid plans start at just15/month—less than half QuickBooks’ entry price. No surprise fees: even advanced features like the auto the late payment chasing and client portals are included in lower tier plans.

QuickBooks starts at $38/month just for basic features—payroll and inventory cost extra.

Easy invoicing for memorable payments. Zoho Books make invoicing so simple it is a competitive edge.

16 (6 vs QuickBooks) brand able instantly templates to invoice. Recurring subscriptions/retainer invoicing (for agencies and SaaS firms) Zero transaction fee “Pay Now” buttons (QuickBooks charges 2.9% + $0.30 per payment) Free plan users get 1,000 invoices a year, enough for most early stage startups.

Bonus. Review and approval rating workflows for teams allows for pre-issuance invoicing assessments.

The Zoho Ecosystem: You’re Business on Autopilot

This is where Zoho Books pulls ahead:

Seamless handoffs between Zoho CRM (track deals), Zoho Inventory (manage stock), and Zoho Projects (bill hours)

Client portals where customers view statements/pay invoices without back-and-forth emails

Bank feeds that reconcile transactions automatically using AI

QuickBooks integrates with more apps, but Zoho’s native connections work like they’re part of one system.

Global Business? Zoho Books Speaks Your Language

For internationally-minded businesses:

- Multi-currency handling with real-time exchange rates

- Auto-compliant tax filings for GST (India), VAT (EU), and sales tax (US)

- Time tracking that converts billable hours into invoices with one click

- QuickBooks charges extra for advanced global features.

Automation That Saves 10+ Hours/Month

Zoho Books anticipates needs like a seasoned CFO:

- “Workflow rules” auto-approve expenses under set amounts or escalate overdue invoices

- Late-fee reminders that politely nudge clients before payments are due

- Receipt scanning via mobile app that matches transactions automatically

- QuickBooks automates too—but often requires add-ons.

- When QuickBooks Might Still Win

- Zoho Books isn’t perfect for everyone. Consider QuickBooks if:

- You have complex payroll needs (Zoho requires third-party payroll apps)

- Your accountant insists on QuickBooks (though many now support Zoho)

- You need industry-specific reports (construction, retail, etc.)

The Verdict? Try Zoho Books If…

You’re a:

- Bootstrapped startup (that free plan is a lifeline)

- Service business (agencies, consultants, freelancers.

- Global seller needing multi-currency/tax support

- Zoho ecosystem user (CRM + Books = magic)

Pro Tip:Zoho’s 30-day free trial includes all premium features—no credit card required. Test drive it during your next tax quarter to see the difference.

Bottom Line: QuickBooks is the “safe” choice, but Zoho Books 2025 proves you don’t need to overpay for accounting software that gets how modern businesses operate. It’s like having a finance team in your pocket—without the finance team prices.

Conclusion

Nobody goes into business to deal with invoices and accounting. And yet, in 2025, we still have to deal with meticulously tracking income, pursuing overdue payments, and dealing with taxation. Thank goodness for the new generation of accounting software— now more than ever, they feel like an overqualified secretary who understands your business and lends you a hand with the tedious tasks. While Zoho Books and QuickBooks both have impressive features, if you’re looking for a solution that balances power with approachability, Zoho Books might just surprise you.

Imagine this— a quarter just ended, and rather than being buried in spreadsheets, you are savoring a warm cup of coffee while your accounting software auto reconciles transactions, sends polite reminders to pay overdue invoices, auto-classifies transactions and suggests tax deductions you had not noticed. That is the Zoho Difference. It focuses on the real world business problems and gives solutions in a way that is straightforward and easy to understand.

What makes Zoho Books shine in 2025? It is the small and mid-sized businesses primary accounting software. The interface is more human than the other software’s. It is not cluttered with inscrutable menus or bloated features you will never use. Creating invoices is a mobile experience. The app allows you to check on your cash flow or approve expenses while you’re in line for your coffee.

For businesses with a global outlook, Zoho Books manages multi-currency transactions and regional tax requirements like GST or VAT as if it were a local bookkeeper in every market you operate in. Beyond accounting, if you want to visualize your business data and uncover insights from all your connected systems, Zoho Analytics offers powerful dashboards and reports. Check out new ways Zoho Analytics helps you see the story behind your data to make smarter business decisions.

However, what makes Zoho Books unique is that it scales with you, not ahead of you. Many entrepreneurs begin using the free plan (which is a rarity in 2025!), and are later able to add features like inventory tracking, project billing, or even client portals as seamlessly as turning on a tap, and without the shocking costs associated with enterprise-tier pricing. For users in the Zoho ecosystem (CRM or Inventory, for example), the integration is nothing short of magical as data flows between apps without the need for copy-paste chaos.

Of course, QuickBooks is still a heavy-hitter, especially with complex payroll needs or businesses that require 500+ integrations. For many, however, the robust features come at steep learning curve and fast accumulating costs. With Zoho Books, however, it feels as if the software is on your team from day one. It is the software equivalent of that one proactive employee who, a step ahead of everyone, automates late-payment reminders, pays vendors at optimal times, and generates financial reports that are immediately easy to comprehend at a glance.

So which should you choose? If you’re a solopreneur on a tight budget, a small team that needs to account for every dollar, or a brand that prides itself on simplicity as much as it does on functionality, Zoho Books is worth a serious look. QuickBooks may have far more name recognition, but in 2025, Zoho Books is the software that proves you have don’t need the “industry standard” to receive industry standard results. The best part? Each one gives you a free trial, after all — because, hey, the right accounting partner should feel like a great fit, not a consolation prize. After all, your software shouldn’t merely take care of money — it should return your most valuable asset to you: your time.